Welcome

|

Step 1 Enroll in the Plan

|

Step 2 Connect online or with Member Services |

Step 3 Meet with your Attorney |

LegalEASE has you covered when you run into life’s legal challenges. With paid-in-full benefits for personal legal matters and the largest and most qualified Provider Network covering all 50 states, the LegalEASE Plan gives members the confidence to take on all legal challenges

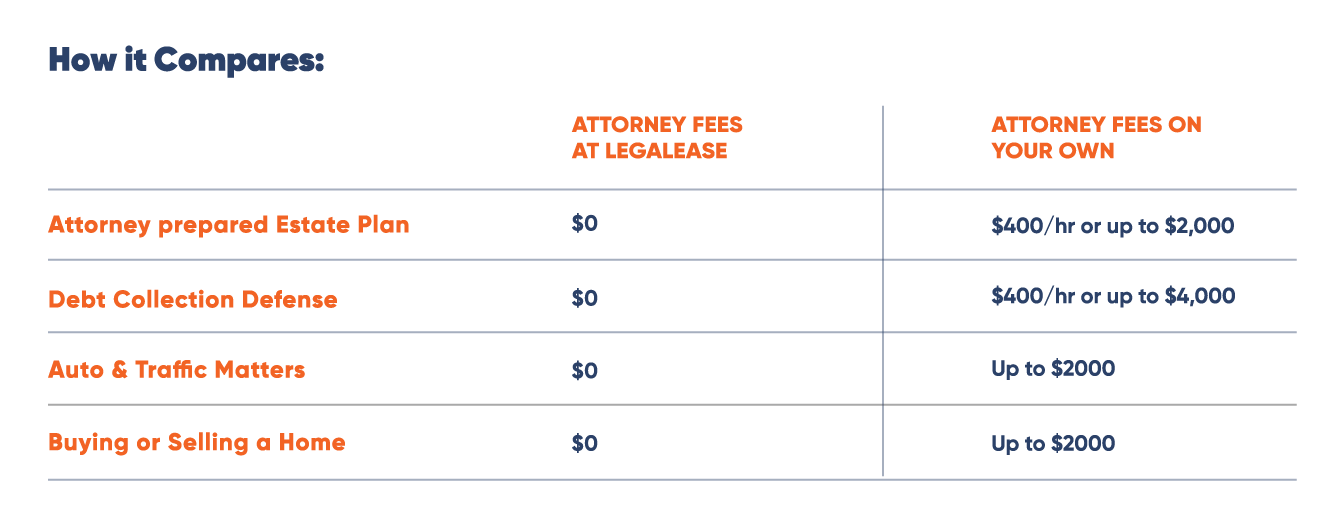

Paid-in-full benefits means your attorney fees are covered for most personal legal matters. See how it compares below, and how the LegalEASE Plan protects you from costly attorney’s fees

|

Access your Benefits

LegalEASE Provides members two convenient methods to access your benefits, LAMP: the LegalEASE Attorney Matching Portal, and Member Services. Each provides top tier access and service to meet all your personal legal needs.

|

|

|

|

LAMP: LegalEASE Attorney Matching Portal Revolutionizing the way our members connect with legal services, LegalEASE proudly unveils a $2 million investment in a state-of-the-art online platform, setting a new standard for efficiency and accessibility in legal support. |

|

|

Member Advocacy Team Setting a new standard for service excellence, Member Services leads not just among legal plan providers but across the service industry, ensuring swift, stress-free legal assistance for every member.

|

|

|

|

Coverage

|

LegalEASE is expanding our online solution options to members. Introducing the newest online self-service portal, LAMP. Now available to access. Learn more |

|---|

Click Here to Download Benefits Summary

The Value of a LegalEASE Benefits Plan.

- Home and Residential

- Financial and Money Matters

- Consumer

- Auto and Driving

- Family and Personal

- Civil Lawsuits

- Estate planning and wills

LegalEASE Benefits Plan Coverage

Benefits are designed to meet the typical needs of a colleague and their family. There are no deductibles to worry about for covered services. Benefits cover the attorney’s time. Other costs such as filing fees or court costs are not covered. Listed below are the types of matters that are covered by the LegalEASE benefits plan. This plan offers the convenience of in-network and out-of-network benefits. Many of the below areas are fully covered in-network.

Plan Cost

The LegalEASE Plan is $8.18 per pay-period, via payroll deduction, based on a 26 pay-period deduction schedule.

Who's Covered?

The Member’s spouse and Member’s unmarried dependent children, including stepchildren, legally adopted children, children placed in the home for adoption and foster children, up to age 26.

Limitations apply.

The policy language listed herein is intended to provide a general overview of a typical LegalEASE policy. Please see your LegalEASE policy for specific coverage amounts and exclusions.

Network

- Experience in the Legal Matter Needed

- Quality Time Spent in Consultations

- Years of Legal Training and Experience

- Up-to-date Legal Training Each Year

- Lawyers Who are Service-Oriented

- Lawyers Who Have a Solid Local Reputation in their Communities

- Exceptional Backgrounds

- Years of Courtroom and Trial Experience

- To comply at all times with the Rules of Civil Procedure and Criminal Procedure and the Rules of Professional Conduct applicable to the jurisdiction.

- To return member's calls promptly, within one business day, and communicate with members such that a member and the member's family do not voice substantiated concerns over promptness or frequency of your or your firm's communication.

- To not enter continuances, adjournments, or the like without the member's comfort and consent.

- To not arrange for substitutions or stand-ins unless the member has been previously advised and that the member understands that you remain responsible for the case and to contact you if there is any concern or if proceedings do not go as planned.

- To always respect a member, their needs and family.

- To maintain a professional office, in staffing and appearance.

- To fully explain yourself such that a member has an understanding for the reasons behind your recommendations and suggestions, even if a member may not hire your firm.

- To not complete any additional work that will result in a fee to the member, where not covered by the member's plan, until a fee arrangement is fully understood by the member and there is a written agreement.

- To help each member individually and ensure that everything you do is in the interest of the member.

- To notify LegalEASE if there is or may be the possibility of a conflict of interest or violation of ethical codes.

- To notify LegalEASE if there may be a misunderstanding or potential service issue where there may be a complaint without breaking any client confidences.

- To direct any grievances or concerns, such as process procedure or billing, to Legal Access and not a member.

- To not refer any member to another attorney without the knowledge and consent of Legal Access if you cannot assist.

- To take responsibility and uphold the highest standards of customer service delivered by any and all firm staff or employees that have interaction with members.

- To communicate and cooperate with LegalEASE on any concern, inquiry or issue and return any communication from Legal Access within one business day.

About

We are here to serve you...

We believe people deserve to have a sense of safety and security, a peace of mind, when it comes to being protected in legal matters that they may not be the experts in. To have access to legal professionals that can ease and solve their legal burdens. We are here to serve you.

How we do it is by providing an in-depth pool of resources to accommodate all your legal needs. Legal Access and LegalEASE have broad experiences with employees in small, medium and large companies in the public and private sectors, local, state and federal government offices, unions, employee assistance plans, work-life companies, and organizations, when it comes to solving your legal matters.

What we do is provide value by creating unparalleled access to a network of skilled attorneys to cover your legal needs with options in convenient plans. We are a diversified employee benefits company engaged in administration, network development, technology management and insurance, based in Houston, Texas. Since 1971, we have grown from five attorneys in Los Angeles providing services to a modest amount of companies into a company with the strongest attorney network across America. We provide assistance to members over half of a million times each year throughout the United States and the world.

Legal Access Companies consists of several companies and brands to best meet customer needs, including but not limited to: Legal Plans USA, Legal Access Plans, LegalEASE, and LAMG. Legal Access Plans has a wide array of products across several market segements, including worksite, employee assistance and worklife. LegalEASE is the group's primary insurance brand and focuses primarily in the worksite market. LegalEASE products are underwritten and presented by Virginia Surety Company, part of the Warranty Group.