Scam Alert: IRS Imposter Calls

Scam Alert: IRS Imposter Calls

Imagine you’re driving home one day and you get a call. Because you’re a responsible driver, you don’t pick up the phone and let it go to voicemail. But the message you hear is daunting.

“Hello, we have made several attempts to reach you. This call is officially a final notice from the Internal Revenue Service. The reason for this call is to inform you that the IRS is filing a lawsuit against you. An urgent callback is necessary.”1

Even our very own CEO, Robert Heston, Jr., received one these calls. However, he was not taken in because he knew that the IRS will always send a written notification of any taxes due via USPS. Note that the IRS, over the phone, will never ask for any credit or debit card information.2

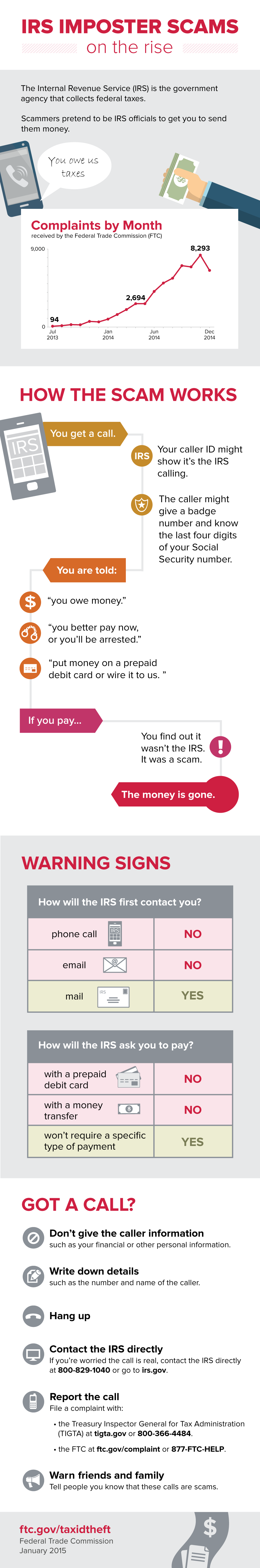

Below is a useful infographic3 created by the Federal Trade Commission about this specific scam.

If you think you have received one or more of these calls, consider not sharing any of your personal information and if you decide to report the call, you may do so here ftc.gov/complaint or 1(877) FTC-HELP.

References

1. Jim Pavia, “Guess what! That’s NOT the IRS calling,” CNBC, Wednesday, 28 Oct 2015, http://www.cnbc.com/2015/10/28/guess-what-thats-not-the-irs-calling.html.

2. “IRS Reiterates Warning of Pervasive Telephone Scam,” IRS, April 14, 2014, https://www.irs.gov/uac/Newsroom/IRS-Reiterates-Warning-of-Pervasive-Tel....

3. “IRS Imposter Scams Infographic,” Federal Trade Commission, January 2015, https://www.consumer.ftc.gov/articles/0519-irs-imposter-scams-infographic.

Disclaimer

© 2016 Legal Access Plans, L.L.C. All rights reserved. Legal Access, LegalEASE and the circle mark are marks of Legal Access Plans. Content is property of or licensed to Legal Access Plans, L.L.C. Content on this site is for general information purposes, should not be relied upon as legal advice, does not constitute a contract or an attorney client relationship.